Indian renewable energy (RE) firms have attractive valuations for raising funds amid rising investor interest, with nearly a dozen transactions at various stages in the market, said Aalok Shah, Managing Director (MD), Co- India head, of the global advisory firm Rothschild & Co.

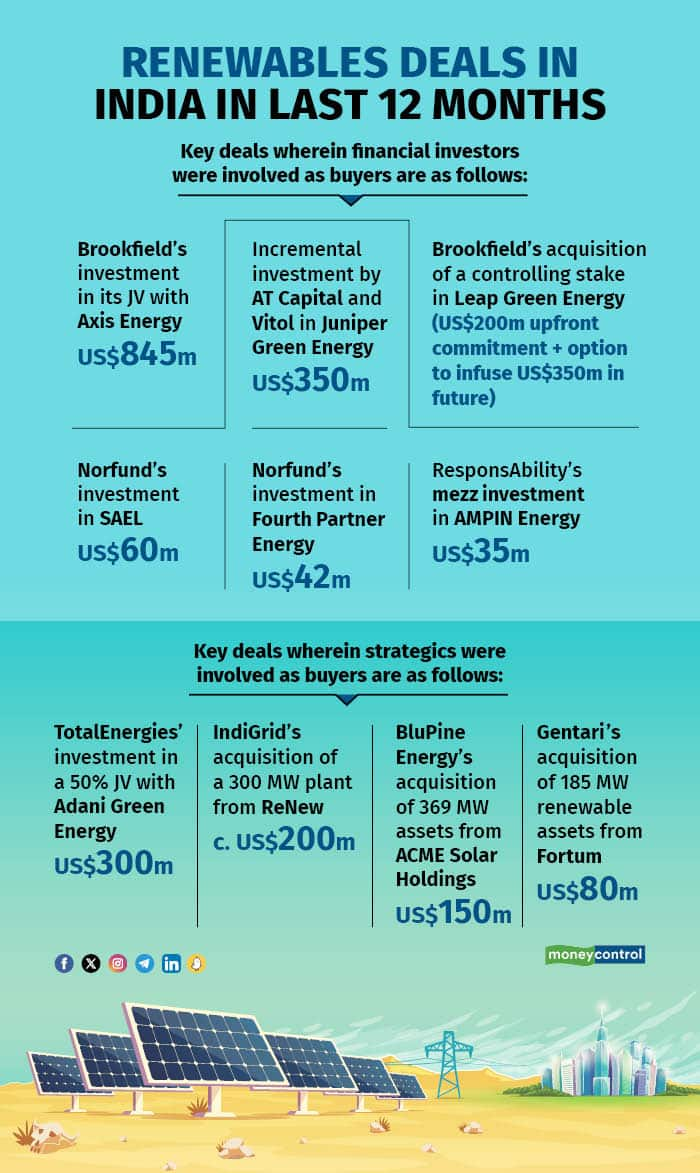

As the country moves closer to its 500 GW target by 2030, the clean energy sector is abuzz with mergers, acquisitions, and various fundraising activities. In the last 12 months, the renewables sector in India has witnessed mergers and acquisitions (M&A) activity to the tune of $3 billion, with both strategic and financial investors being active, according to Rothschild.

Rothschild has advised more than 10 deals in the renewable space. The firm played a key role in the CleanMax deal, where Canadian investment firm Brookfield took controlling stake with a $360 million investment.

"I think there's enough activity in the space, and you'll see more deals getting signed in the next few months because many of these transactions are in the diligence phase," Shah told Moneycontrol in an interview.

"There are almost 12-plus transactions in the market at the moment, at different stages for different types of deals."

He highlighted that the renewables space is witnessing exits by funds on reaching the end of their holding period, and the recycling of capital, especially from European players.

In FY24, equity inflow in India’s RE sector amounted to $4 billion across IPPs (independent power producers) and the renewables ancillary sector. India added 18 gigawatts (GW) of RE capacity in the last financial year, which significantly trails the government's target of adding 50 GW annually to reach the 500 GW target by 2030.

Key deals in the sector include Brookfield's $845 million investment in its joint venture (JV) with Hyderabad-based Axis Energy Ventures, and TotalEnergies' investment of $300 million through a 50:50 JV with Adani Green Energy.

The RE space received investments worth $70 billion between 2014-2021, per government data. Despite this substantial influx, investor interest is yet to reach its peak. Shah highlighted that Middle Eastern and Asian investors are increasingly drawn to the market, thanks to favourable government policies and substantial growth potential.

As of now, India’s RE capacity is 180.79 GW, with solar power leading the way. Private sector leaders like JSW Energy and Adani Group have announced investments worth Rs 1.5 lakh crore and Rs 2 lakh crore , aiming for 20 and 40 GW of generation capacity, respectively, by 2030.

Conglomerates in the space are raising capital via qualified institutional placements (QIPs), where companies raise capital by issuing shares to investors with significant financial resources.

"Currently, valuations are fairly attractive for raising capital, and there is enough demand in the market from investors looking to get into clean energy stocks," Shah said, adding that the sector would need about $370 billion in RE and allied-infrastructure by 2030.

Debt refinancing

According to Shah, between FY25 and FY27, green bonds worth $7 billion are set to mature and may need refinancing. He pointed out that companies are increasingly refinancing their overseas debt with rupee bonds.

"It's a mix of new debt for growth, and the earlier debt getting refinanced using new rupee debt. Earlier, when interest rates were low, it made sense to borrow in the US and Europe in euros or dollars. Now that interest rates have gone up there, the difference in borrowing in the US or Europe versus borrowing in India has disappeared. So it's just easier for them to borrow in India itself," Shah added.

Outlook

Last month, the union budget allocated Rs 19,100 crore for the Ministry of New And Renewable Energy, stepping up its allocation by 46 percent amid climate goals.

Commenting on the move, Shah said, "This will have an impact in terms of more clean energy getting pumped into the system. Capital will be required from private sources, because though the government must do all it can, we will still need a lot of capital. About $370 billion of capital — a mix of debt and equity — needs to come into the sector."